what is fsa health care 2020

Pre-tax dollars are put aside from your paycheck into your FSA. 16 rows Your Health Care FSA covers hundreds of eligible health care services and products.

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

. The Health Care Flexible Spending Account FSA allows you to pay for many health care expenses with pre-tax dollars. This is our 2020. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to.

Callaghan OHare Reuters. A flexible spending account FSA is similar to an HSA but there are a few key differences. At the height of the coronavirus.

An Flexible Spending Account FSA is a valuable. FSA limits typically dont remain static. Temporary rules under the 2020 Cares Act that allowed you to roll over.

October 31 2022 308 PM ET. You can use your Health Care FSA HC FSA funds to pay for a wide. The IRS raised contribution limits for.

Healthcare FSAs are a type of spending account offered by employers. A full FSA is a benefits account to which you contribute pre-tax funds money deducted from your paycheck before payroll taxes are calculated. Its a popular option in many employer.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. What is the FSA amount for 2020. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

Workers may want to keep an eye on the balance in their health-care flexible spending account. For that reason its important to check the limits each year before you determine your contributions. You can also contribute up to 3050 to the Health Care FSA for.

One of the biggest benefits of. But with open enrollment for the 2020. Easy implementation and comprehensive employee education available 247.

Choose a HealthEquity FSA and see how easy it is to. For one self-employed individuals arent eligible. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

An FSA empowers you to set aside pre-tax money from every paycheck to help pay for qualified medical expenses. 19 hours agoThe Worst Pediatric-Care Crisis in Decades. A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in.

When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether. Your Health Care FSA covers hundreds of eligible health care services and products. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Your employer may also choose to. In 2020 the limit is 2750 for a health care FSA. An FSA is a type of savings account that provides tax advantages.

A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Spend Your Fsa Money Before It S Gone Employee News

Which One Is Better For Me An Fsa Or Hsa Bri Benefit Resource

Fsa Hsa Healthcare And Money Saving Blog The Healthcare Hustlers

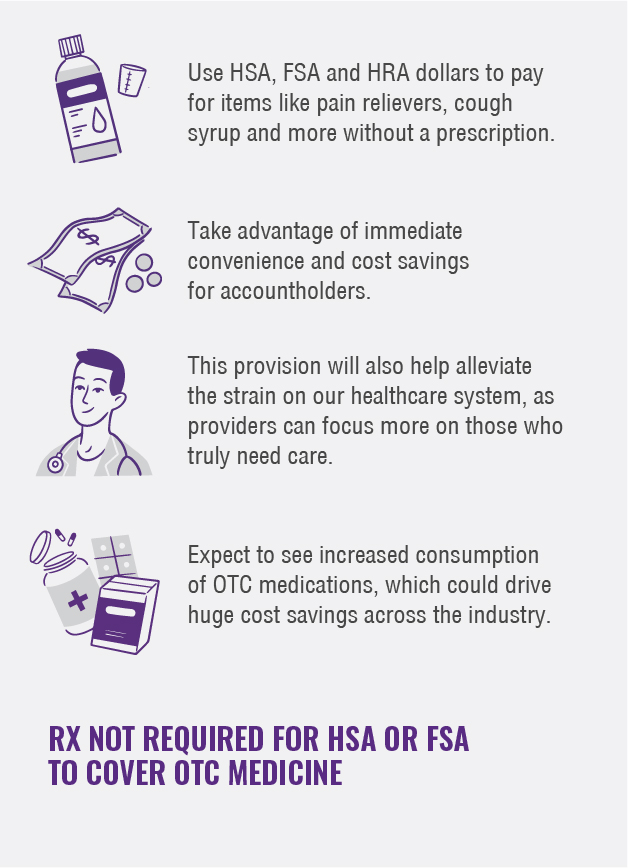

Cares Act Buying Over The Counter Medicine With An Hsa Just Got Easier

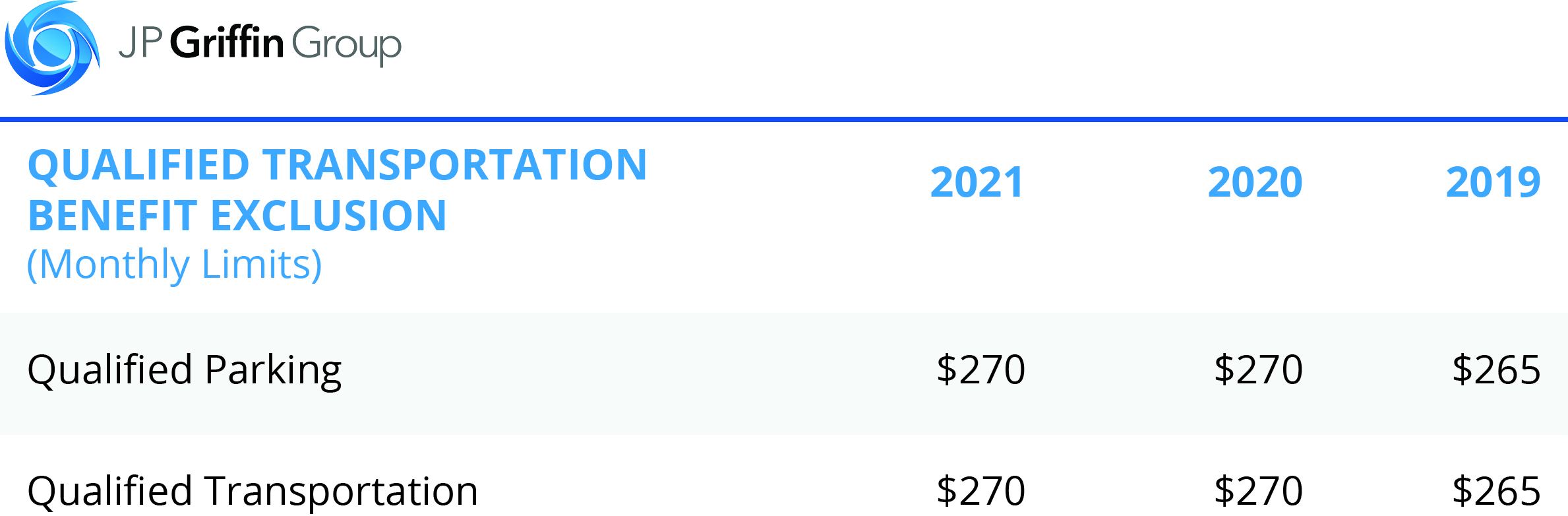

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Charlottesville City Schools Flexible Spending Accounts Fsa 2020 2021 Pierce Group Benefits

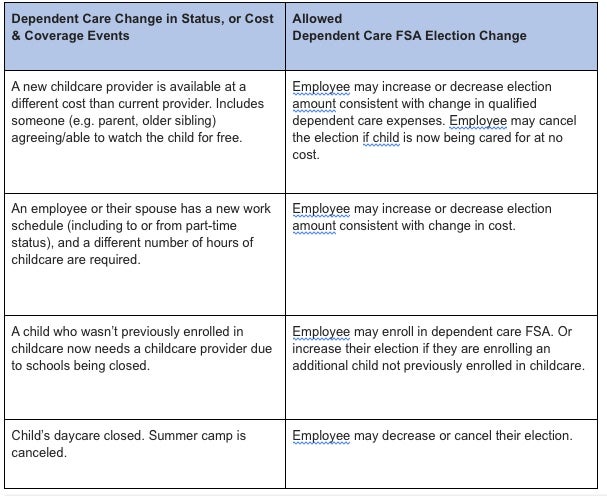

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

What Is The Difference Between Fsa And Hsa Updated 2020 Stephen Zelcer

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Irs Changes To Contribution Limits For 2020 Brio Benefits

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Best Flexible Spending Account Fsa And Health Saving Account Hsa Eligible Items On Amazon The Healthcare Hustlers

Should You Add An Hsa Or An Fsa To Your Health Benefits For 2020